We are closing in on the midway point of 2014 and it’s shaping up to be the year online

video reaches its tipping point in capturing brand dollars. A recent report showed for the first

time, Internet ad revenues have passed broadcast TV revenues. Brands now have to take into consideration that we’re living in a multiscreen world with people watching more and more content online. But they also have to be fully aware engagement is key or viewers will bypass ads, similar to fast forwarding through every commercial on the DVR.

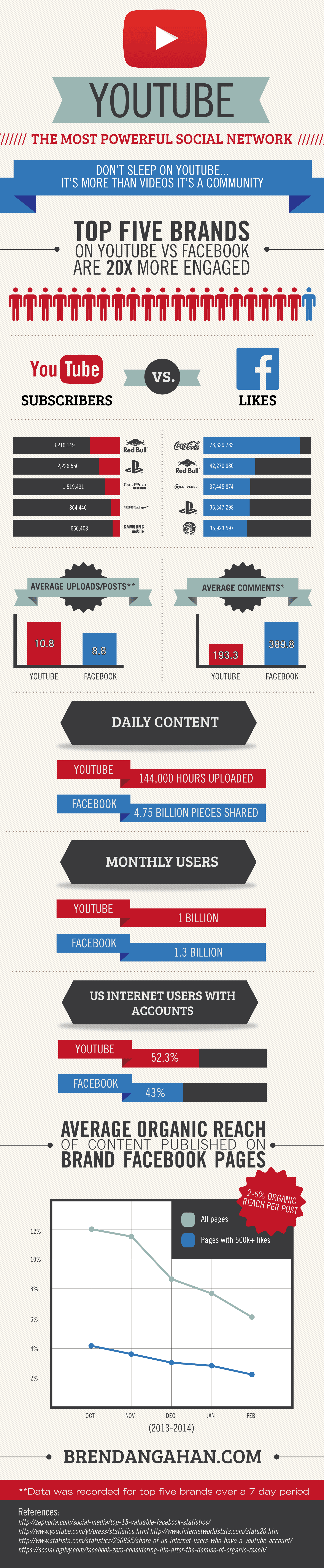

When it comes to large platforms for brands, Facebook is where brands used to look in the past, but this is 2014 not 2008. Facebook’s declining organic reach and insistence upon brands needing to pay to reach the audiences they’ve spent millions to acquire has left many brands frustrated. Meanwhile, YouTube, with its higher engagement metrics and earned media potential is in a prime position to capitalize and capture brand dollars.

A recent study this February found companies’ posts only reach around 6% of their fans organically on Facebook. This means if your Facebook page has 100,000 fans, only 6,000 of them are likely to see the post. The other 94,000 won’t know your post existed unless they go to your Facebook page and the chances of that happening are even slimmer. Facebook is hinting in the near future brands and companies should expect organic reach to be zero.

Some brands have stopped using Facebook altogether and are going to other platforms. Food site Eat24, which had over 70,000 likes, wrote a “breakup letter” saying they were deleting their page because Facebook is no longer a true social network. This could be the first of many of brands jumping ship on Facebook and taking up real estate elsewhere.

Facebook says the reason for gradual decline in organic reach is because of increased competition for limited space in the newsfeed for brands. Content being produced is being created at a faster rate than people can consume it. An average of 4.75 billion pieces of content are being shared daily on Facebookand 58% of consumers have liked at least one brand page.

While one brand leaving the platform is hardly a diaspora, it’s likely brands will be looking elsewhere to engage with their fans and YouTube is the likely candidate. According to data I recently pulled across the top five brands on each platform, the engagement rate of YouTube compared to Facebook is 20 times greater (infographic below).

Highly engaged viewers drive sales and according to YouTube, four in ten shoppers visit a store in person or online as a direct result of watching a video. In addition, 34% of apparel shoppers said they were more likely to make a purchase after viewing an online video. So, while Facebook fans are becoming less engaged and seeing a steady decline of the youth demo, losing 25.3% over the last three years, YouTube is going in the opposite direction. As I mentioned in a previous post, YouTube has a massive young user base, with more US adults ages 18-34 than any cable network.

At a time when Facebook is alienating advertisers, YouTube is aggressively courting them. Three weeks ago YouTube launched an aggressive print, TV, and outdoor ad campaign, as well as its Google Preferred program, which provides upfront media packages to make itself more palatable to more traditional advertisers.

Brands such as Taco Bell, named marketer of the year for 2013, are generating significant sales and touting YouTube influencers as core to its digital strategy. Now others are likely to follow suit.

It’s not unlikely we’ll see more brands follow Eat24’s lead, opting out of investing in a platform in which engagement is continuing to decline. Meanwhile, YouTube’s aggressive moves to acquire advertisers and overwhelming engagement rates leaves the platform primed to welcome brands looking for alternatives.

No comments:

Post a Comment